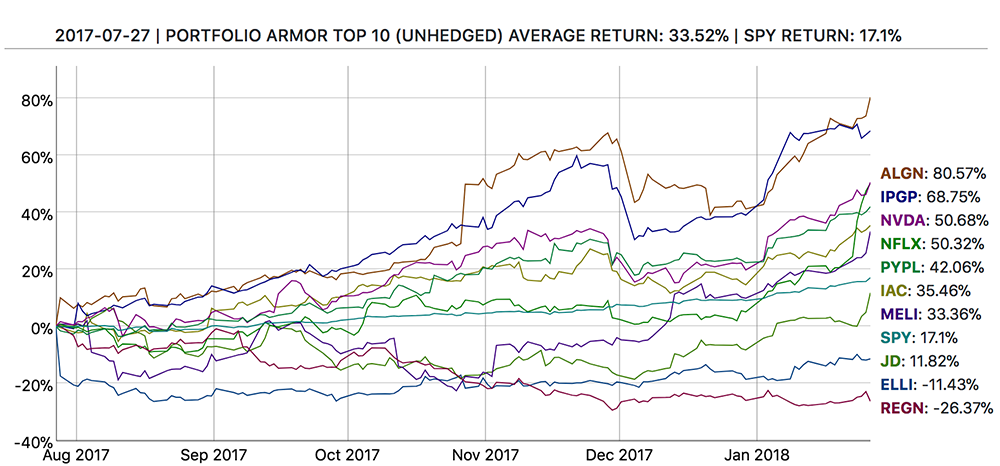

Since June of 2017, we've been posting Portfolio Armor's top ten names ranked by potential return, net of hedging cost, and tracking their unhedged performance in real time. We post the performance of weekly top names cohorts in the table below, six months after we share them with subscribers.

This was when we first started sharing our weekly top names cohorts in the Portfolio Armor Substack.

| Starting Date | Portfolio Armor 6-Month Performance | SPY 6-Month Performance |

|---|---|---|

| December 29, 2022 | 30.83% | 14.28% |

| January 5, 2023 | 39.29% | 16.77% |

| January 12, 2023 | 29.76% | 12.34% |

| January 19, 2023 | 47.45% | 17.09% |

| January 26, 2023 | 34.69% | 12.55% |

| February 2, 2023 | 2.43% | 8.04% |

| February 9, 2023 | 4.28% | 9.50% |

| February 16, 2023 | 13.19% | 7.68% |

| February 23, 2023 | 30.35% | 10.54% |

| March 2, 2023 | 17.52% | 13.46% |

| March 9, 2023 | 23.69% | 13.77% |

| March 16, 2023 | 5.21% | 11.96% |

| March 23, 2023 | 10.08% | 9.47% |

| March 30, 2023 | 8.69% | 5.87% |

| April 6, 2023 | 16.34% | 4.97% |

| April 13, 2023 | -2.18% | 4.37% |

| April 20, 2023 | 6.46% | 2.27% |

| April 27, 2023 | 9.27% | -0.42% |

| May 4, 2023 | 13.08% | 7.30% |

| May 11, 2023 | 8.38% | 6.91% |

| May 18, 2023 | 9.76% | 7.53% |

| May 25, 2023 | -3.36% | 8.68% |

| June 1, 2023 | -6.14% | 8.82% |

| June 8, 2023 | 12.56% | 7.23% |

| June 15, 2023 | 18.98% | 6.05% |

| June 22, 2023 | 9.20% | 8.50% |

| June 29, 2023 | 11.19% | 8.51% |

| July 6, 2023 | -0.97% | 6.44% |

| July 13, 2023 | -0.61% | 6.03% |

| July 20, 2023 | -5.09% | 6.67% |

| July 27, 2023 | 4.58% | 7.73% |

| August 3, 2023 | 20.98% | 10.10% |

| August 10, 2023 | 35.36% | 12.38% |

| August 17, 2023 | 89.36% | 14.48% |

| August 24, 2023 | 62.21% | 16.24% |

| August 31, 2023 | 30.69% | 12.76% |

| September 7, 2023 | 44.28% | 15.72% |

| September 14, 2023 | 33.80% | 14.34% |

| September 21, 2023 | 50.57% | 21.00% |

| September 28, 2023 | 38.33% | 22.10% |

| October 5, 2023 | 60.60% | 22.13% |

| October 12, 2023 | 29.80% | 17.78% |

| October 19, 2023 | 32.94% | 16.12% |

| October 26, 2023 | 30.98% | 23.16% |

| November 2, 2023 | 33.77% | 17.26% |

| November 9, 2023 | 51.42% | 19.90% |

| November 16, 2023 | 36.23% | 17.46% |

| November 22, 2023 | -3.42% | 16.44% |

| November 30, 2023 | 23.71% | 14.55% |

| December 7, 2023 | 51.69% | 16.56% |

| December 14, 2023 | 28.08% | 15.00% |

| December 21, 2023 | 25.44% | 15.20% |

| December 28, 2023 | 51.40% | 14.17% |

| January 4, 2024 | 17.27% | 18.00% |

| January 11, 2024 | 27.97% | 16.82% |

| January 18, 2024 | 11.02% | 15.99% |

| January 25, 2024 | -0.45% | 10.32% |

| February 1, 2024 | 6.55% | 11.01% |

| February 8, 2024 | 2.51% | 6.49% |

| February 15, 2024 | 1.22% | 10.18% |

| February 22, 2024 | -8.19% | 9.60% |

| February 29, 2024 | -19.66% | 9.96% |

| March 7, 2024 | -19.09% | 4.98% |

| March 14, 2024 | 1.34% | 9.14% |

| March 20, 2024 | 8.97% | 9.14% |

| March 28, 2024 | 3.11% | 9.21% |

| April 4, 2024 | -6.61% | 11.67% |

| April 11, 2024 | -0.30% | 11.89% |

| April 18, 2024 | 30.87% | 17.05% |

| April 25, 2024 | 26.34% | 15.02% |

| May 2, 2024 | 12.34% | 13.07% |

| May 9, 2024 | 4.78% | 15.00% |

| May 16, 2024 | 7.68% | 10.77% |

| May 23, 2024 | 26.28% | 13.22% |

| May 30, 2024 | 16.76% | 15.30% |

| June 6, 2024 | 37.35% | 13.69% |

| June 13, 2024 | 12.11% | 11.40% |

| June 20, 2024 | 37.41% | 8.01% |

| June 27, 2024 | 5.84% | 8.86% |

| July 3, 2024 | -3.45% | 7.34% |

| July 11, 2024 | 25.46% | 4.31% |

| July 18, 2024 | 19.24% | 8.11% |

| July 25, 2024 | 48.33% | 12.92% |

| August 1, 2024 | 18.09% | 10.83% |

| August 8, 2024 | 57.74% | 13.23% |

| August 15, 2024 | 29.11% | 10.24% |

| August 22, 2024 | 10.36% | 7.85% |

| August 29, 2024 | 19.98% | 6.37% |

| September 5, 2024 | 22.18% | 6.09% |

| September 12, 2024 | -18.38% | -0.04% |

| September 19, 2024 | 2.03% | -0.67% |

| September 26, 2024 | -23.43% | -0.65% |

| October 3, 2024 | -9.43% | -5.48% |

| October 10, 2024 | -11.46% | -8.95% |

| October 17, 2024 | -6.98% | -9.62% |

| October 24, 2024 | 3.18% | -5.63% |

| October 31, 2024 | -2.40% | -2.46% |

| November 7, 2024 | 1.58% | -5.75% |

| November 14, 2024 | -1.30% | -0.97% |

| November 21, 2024 | 2.52% | -1.80% |

| November 27, 2024 | 23.89% | -1.28% |

| December 5, 2024 | 19.75% | -2.24% |

| December 12, 2024 | 1.69% | -0.10% |

| December 19, 2024 | 24.15% | 1.94% |

| December 26, 2024 | -5.34% | 1.76% |

| January 2, 2025 | 33.47% | 6.13% |

| January 8, 2025 | 21.00% | 5.23% |

| January 16, 2025 | -3.88% | 5.50% |

| January 23, 2025 | -8.73% | 4.01% |

| January 30, 2025 | 17.92% | 4.86% |

| February 6, 2025 | 16.57% | 4.36% |

| February 13, 2025 | -6.28% | 5.73% |

| February 20, 2025 | 1.87% | 4.50% |

| February 27, 2025 | 18.81% | 9.98% |

| March 6, 2025 | 38.54% | 12.94% |

| March 13, 2025 | 81.73% | 19.22% |

| March 20, 2025 | 85.55% | 17.27% |

| March 27, 2025 | 81.64% | 16.78% |

| April 3, 2025 | 54.48% | 24.63% |

| April 10, 2025 | 48.97% | 24.66% |

| April 17, 2025 | 78.77% | 26.33% |

| April 24, 2025 | 34.75% | 23.83% |

| May 1, 2025 | 37.09% | 22.10% |

| May 8, 2025 | 24.56% | 18.84% |

| May 15, 2025 | 50.05% | 13.75% |

| May 22, 2025 | 33.11% | 13.11% |

| May 29, 2025 | 44.72% | 15.88% |

| June 5, 2025 | 48.39% | 15.68% |

| June 12, 2025 | 27.27% | 12.99% |

| June 18, 2025 | 18.22% | 13.10% |

| June 26, 2025 | 15.41% | 12.77% |

| July 3, 2025 | 16.11% | 9.28% |

| July 10, 2025 | 32.31% | 10.88% |

| July 17, 2025 | 34.42% | 10.14% |

| July 24, 2025 | -4.39% | 8.62% |

| July 31, 2025 | 37.31% | 9.39% |

| August 7, 2025 | 27.63% | 9.23% |

| August 14, 2025 | 29.45% | 5.77% |

| August 21, 2025 | 28.56% | 8.46% |

| August 28, 2025 | 2.15% | 5.67% |

| September 4, 2025 | 23.97% | 5.60% |

| Average | 20.35% | 10.10% |

So Portfolio Armor's top ten names averaged 20.35% over the average of these 141 6-month periods, versus SPY's average of 10.10%.

In June of 2022, we updated the way we select our top names, by adding a new factor.

See performance data starting June, 2022 See performance data starting June, 2017