You decide how much risk you're willing to take.

Portfolio Armor presents you with a portfolio of optimally hedged securities constructed to give you the highest expected return possible given your risk tolerance.

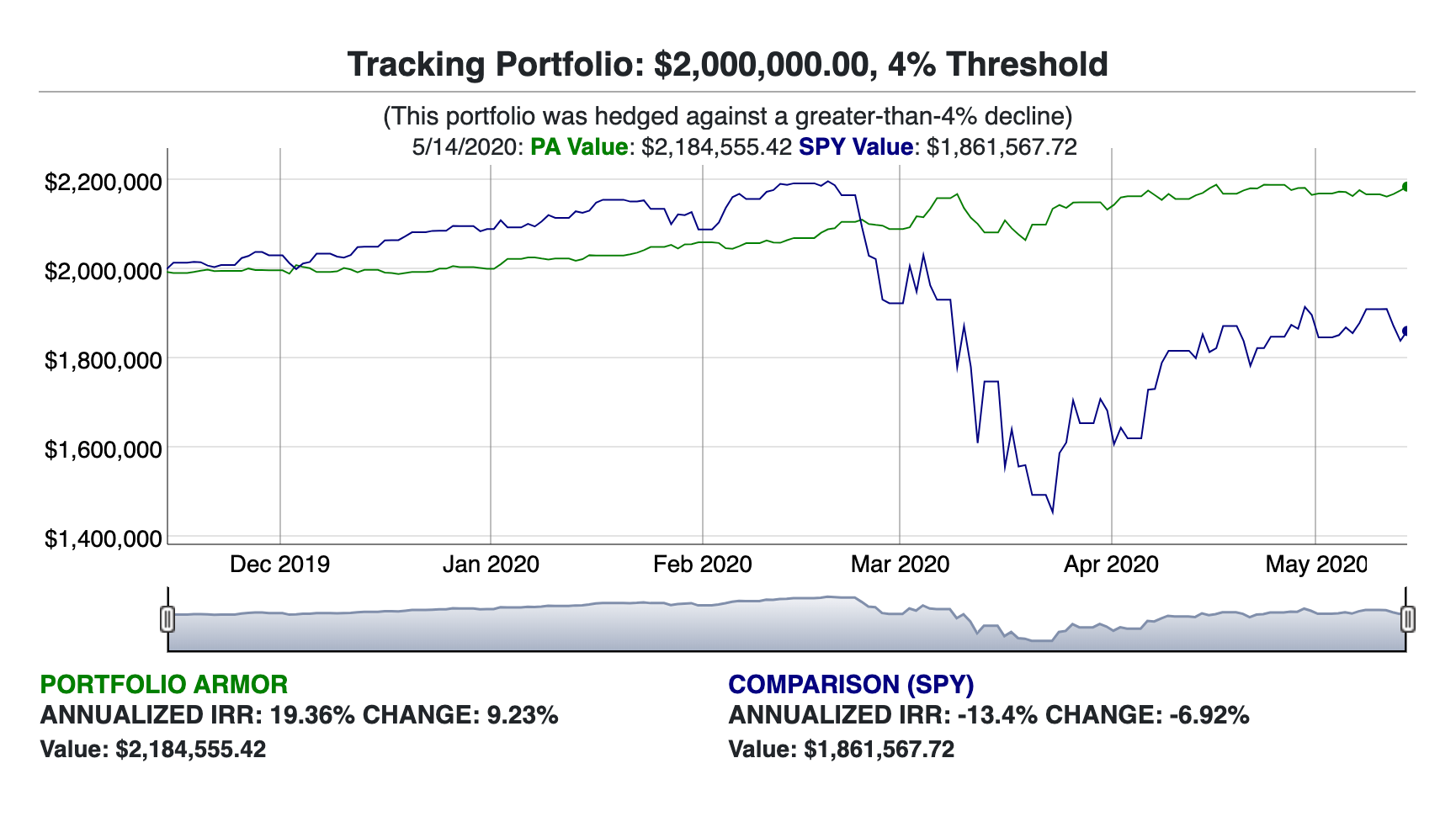

You enter the dollar amount you want to invest, and the maximum decline you are willing to risk over the next six months (your "threshold"). Then, Portfolio Armor presents you with a concentrated portfolio of securities built to maximize your expected return over the next six months while strictly limiting your potential downside to the risk you're willing to take.

There are more than 4,000 hedgeable securities (stocks and exchange traded products such as ETFs) trading in the U.S. Portfolio Armor calculates potential returns for each of them every trading day, using an analysis of historical returns as well as options market sentiment to estimate the maximum each security will perform over the next six months. From that, we derive expected returns, which represent more likely returns for each security.

Since you're going to hedge these securities, you don't just want them to have high potential returns - the cost of hedging counts too. So we scan for ones that have the highest potential returns net of hedging costs, the ones with the highest net potential returns.

Although Portfolio Armor is a very sophisticated tool capable of providing useful calculations it is not designed to replace the advice of a professional investment counselor or your own independent investment research and independent calculations. To rely solely upon the Portfolio Armor tool for investment decisions would be extremely unwise.