Portfolio Armor uses a proprietary algorithm to scan for optimal puts and optimal collars. For more about that algorithm, click here. For more about put options and collars in general, and how they work as hedges, see below.

Put options (often simply called "puts") give an investor the right, but not the obligation, to sell a particular security at a specified price (the strike price of the option), on or before a certain date (the expiration date of the option).

Let's say you own a stock that is currently trading at $30 per share. The most you are willing to see this stock drop is 20%, which would be down to a price of $24 per share. If you own a put option on that stock with a strike price of $24, you would have locked in the right to sell that stock for $24 – even if the price of the stock drops below $24. Note that you would not want to exercise the put option when the stock price is above $24; this is why owning a put option represents the right to sell the stock rather than an obligation.

Not every stock or ETF has put options traded on it, and for those that don't, you might consider using a limit sell order. But limit sell orders may not protect you if your stock or ETF exhibits a downward jump in price. For example, consider the previous case, where you own a stock that is currently trading at $30 per share, and you don’t want to see it go below $24. This time, instead of buying a put option with a strike price of $24, you just place a limit order to sell your shares if they drop to $24. The risk you face in this case is that, in the event of significantly bad news, your stock could drop from $30 to $20, $15, or lower without trading at $24 on the way down.

In the event the stock price gaps downward like that, your limit order would not have let you sell at $24; on the other hand, had you owned puts on this stock with a strike price of $24, you would have been able to sell the stock at $24 even with a downward jump to a new market price much lower than $24.

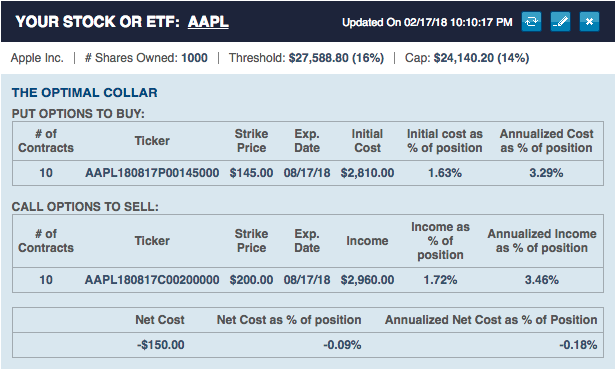

A collar is a strategy that pairs buying a protective put option on a stock or ETF with selling a call option on the same security. A call option is the opposite of a put option: it gives an investor the right, but not the obligation, to buy a particular security at a specified price (the strike price of the option), on or before a certain date (the expiration date of the option). By selling a call option, you are giving an investor the right to buy your stock or ETF if it appreciates beyond a certain level, and obligating yourself to deliver the stock or ETF if the option is exercised; in this way you are "capping" your potential upside. In return, you are being paid by the buyer of the call option. The income you receive from selling the call option offsets some of the cost of buying the protective put option, so your net cost in opening a collar can be lower than the cost of just buying a protective put. in some cases, such as in the Apple, Inc. (AAPL) example above, the net cost of a collar can be negative, meaning that you would effectively be getting paid to hedge.

Portfolio Armor's capability to construct hedged portfolios maximized for expected return is built on the same algorithm that powers its capability to hedge individual securities.